Finance and National Planning Minister, Situmbeko Musokotwane, has highlighted the long-term benefits of granting tax expenditures, stating that while they may reduce immediate revenue collections, they ultimately stimulate economic growth and enhance tax revenues.

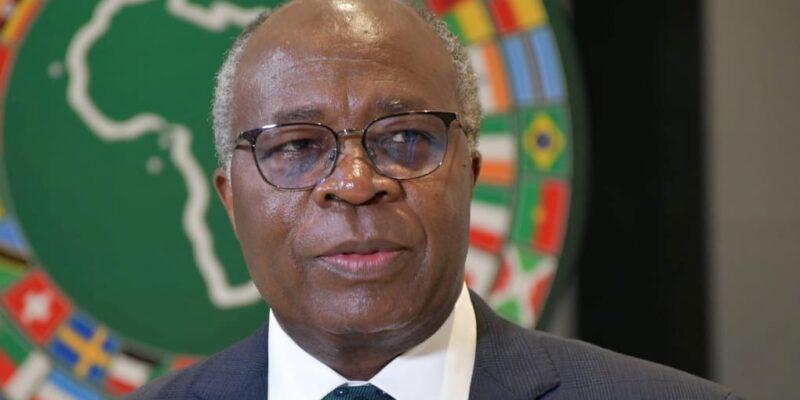

Speaking on Wednesday during the announcement of Zambia’s first-ever Tax Expenditure Report for the fiscal year 2023, Musokotwane said the initiative aligned with the UPND government’s commitment to transparency and accountability in managing public resources.

“Tax expenditures are a strategic tool to support economic and social objectives by forgoing immediate tax revenue. They help attract investments, promote social equity, and support key sectors, thereby expanding the revenue base in the long run,” he explained.

Musokotwane added that a robust economy fueled by increased investment flows enhances the government’s capacity to fund infrastructure development and public services.

The 2023 Tax Expenditure Report, prepared in compliance with Section 7(1)(o) of the Public Finance Management Act of 2018, details tax relief measures such as deductions, credits, exemptions, differential rates, deferrals, and tax holidays.

Key highlights of the report include the role of tax expenditures in attracting domestic and foreign investments, encouraging growth in emerging industries and supporting Public Benefit Organisations (PBOs) in providing free or low-cost services in education, health, water, and sanitation, as well as humanitarian relief.

Musokotwane emphasized that such measures directly contributed to social welfare and economic resilience.

“The public can rest assured that these tax expenditures align with policy objectives aimed at fostering sustainable development and improving the quality of life for all Zambians,” he said.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments