A new survey by TransUnion has revealed a mixed financial outlook for Zambian consumers in the second quarter of 2023.

The report, dubbed Consumer Pulse Study for quarter 2, also highlighted a decline in access to credit and consumer confidence in the credit market, and that nearly 96 percent of consumers believe access to credit is crucial.

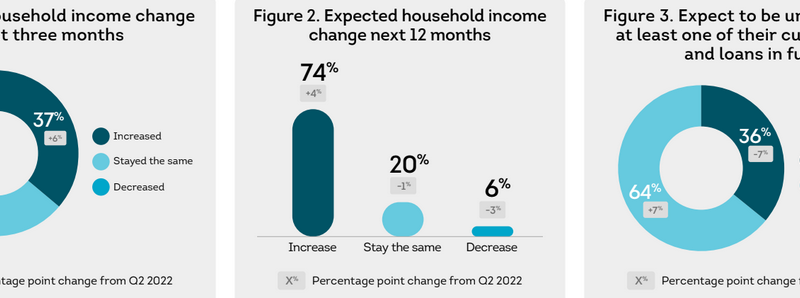

The report on Zambian financial consumer pattern made available to the Zambian Monitor stated that while almost four in 10 saw an upswing in their income during the past quarter, and eight in 10 expect their incomes to increase in the coming year, many are bracing for an increase in their bill and loan obligations in the coming quarter, which will see them spending less.

“Part of the reason for this prudent approach is that nearly four in Zambian consumers are expecting increased financial obligations, which will cause nearly half of consumers of all ages to cut back on their discretionary spending and 40 percent to limit large purchases in the next three months,” the report suggested.

Weihan Sun, Director of Research and Consulting at TransUnion Africa, observed that the cautious outlook on future expenditure suggests that Zambian consumers were prioritising financial responsibility, indicating a noteworthy shift in spending habits.

He said respondents were said to have been taking different approaches to managing debt and loans in times of financial uncertainty.

“Of those unable to pay their bills in full, 43 percent choose to pay off their debts in instalments. Close to a third are prepared to dip into their savings to meet their financial commitments, while 29 percent are considering borrowing from friends and family,” Sun said.

Read more :zambias-private-sector-returns-to-growth-in-may-backed-by-expansions-in-output-new-orders

In terms of managing financial choices, the report stated that about 94 percent of the consumers acknowledged the significance of credit monitoring, and the survey indicates that more than half of consumers regularly check their monthly credit reports.

However, Sun said it is ‘concerning’ that 30 percent of consumers do not monitor their credit reports adding that this highlights the need for more education and tools to support regular credit monitoring.

On the other hand, digital fraud attempts remain a pressing issue for Zambian consumers, with 76 percent of those surveyed reporting that they had been targeted by such schemes in the last three months.

Read more : money Report: Sustained demand in Friday’s trading slightly weakens Kwacha against dollar

“Unfortunately, nine percent were targeted and fell victims,” Sun stated.

The report names the most common types of fraud schemes as money/gift card scams of about 46 percent of respondents ‘smishing’ (fraudulent text messages aimed at tricking the recipient into revealing personal data.

“As a result, Zambian consumers are highly concerned about the security of their personal information, with 95 percent expressing apprehension about sharing their personal details.

The data highlights the crucial importance of trust and robust cybersecurity measures in financial transactions and interactions.

“Overall, it’s clear that consumers are increasingly aware of the risks associated with digital fraud. With rampant scams, consumers are cautious about sharing personal information, fearing privacy invasion and identity theft. This indicates a significant need for stronger security measures and robust fraud prevention strategies in the digital space,” Sun said.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments