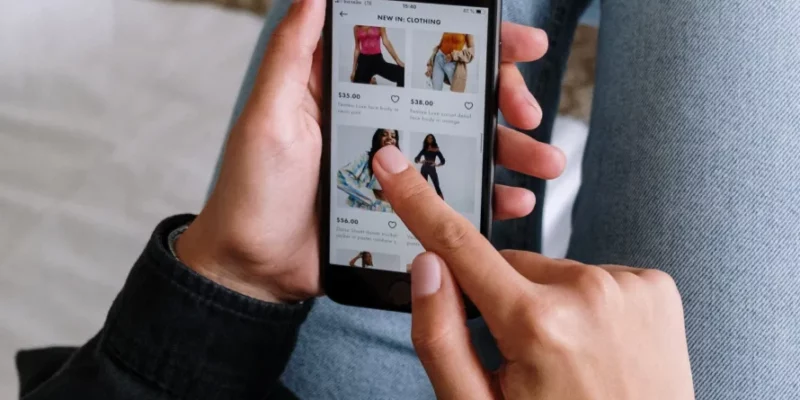

TransUnion Zambia chief executive officer Mildred Stephenson has warned that as Zambia and the region accelerate the shift to transact online, fraud is shifting digitally as well.

Stephenson said businesses must give their customers the smoothest possible on-boarding experience on digital channels, but traditionally fraud detection gets in the way of this.

“Digital on boarding helps businesses offer greater digital access to products and services, while addressing fraud threats,” she said.

Stephenson said in this new banking and credit landscape, risk-based pricing is becoming an industry standard.

Lenders, she said, increasingly require deep insights into their customer base and general market trends to develop and implement appropriate pricing strategies across products and consumer segments.

Read more:E-commerce fraud in Zambia spikes, hits 104% | Zambia Monitor

Stephenson called for identity verification, fraud prevention and collections solutions to assist in managing risk and optimising growth throughout the portfolio.

She said this in a statement by associate and media lead Peter Mokoko on Thursday.

To adjust to the new market conditions, she said lenders must evolve their ecosystems and take a more insight-led approach to customer segmentation.

“Digital lending platforms allow lenders to automate the process decision-making process and assess risk more accurately while creating a superior customer experience,” Stephenson said.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments