The ninth annual insurance conference has officially opened with a focus on how the sector can be a catalyst for economic resilience and make broader positive social transformation.

The conference, which officially opened on Thursday in Chongwe, serves as a platform that brings industry leaders together to discuss and explore innovate ways of responding to market needs in an ever-evolving landscape of insurance while contributing to the overall economy.

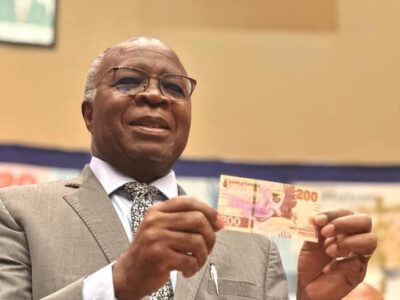

Finance and National Planning Minister, Situmbeko Musokotwane, opened the conference with a belief that a strong and viable financial system was a catalyst to development which provided a channel for wealth creation.

Musokotwane noted that insurance did not only promote economic resilience, but also played a pivotal role in ensuring that the social welfare of people was enhanced.

He said this in a speech read on his behalf by Ministry’s acting Permanent Secretary, Ireene Kauseni.

“We are closely monitoring the process of implementing the insurance Act No. 38 of 2021 and the accompanying regulations that have been developed in order to ascertain its responsiveness to the needs of users and participants in this critical sector,” Musokotwane said.

PIA acting Registrar and Chief Executive Officer, Namakau Ntini, spoke of the need for insurance entities to be financially sound with good governance structures and risk management practices for them to respond appropriately to challenges in the sector.

Ntini recalled that the insurance industry for a very long time yearned for a regulatory environment that would support the dynamic landscape of its industry, saying it now had one through the Insurance Act No. 38 of 2021.

“As your regulator, we are confident that a financially sound insurance industry is better placed to respond to policyholder needs and contribute effectively to social and economic transformation at micro and macro level.

“The authority remains committed to support entities that are resolved to fully implement the provisions of insurance act. This is because at the core of our industry are consumers who must have reasonable trust in the industry in order for us to continue to record sustainable growth,” she said.

Meanwhile, Insurers Association of Zambia (IAZ) president, Moses Siame, raised concerns on some issues in the new insurance act.

Siame cited medical scheme providers that were operating like medical insurers, but were not licensed and supervised as insurance providers.

“We therefore appeal to government that those institutions might be brought to comply with the same requirements as insurers running medical schemes. Not only will it level the playing field, but it will also ensure accountability by all service providers,” he said.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments