Indo Zambia Bank (IZB) has announced a 19.82 percent increase in its net profit after tax for 2024, reaching K724 million, up from K604 million the previous year.

This achievement comes despite challenges such as a severe drought that affected Zambia’s energy and agriculture sectors, as well as broader economic indicators like inflation, interest rates, and the value of the local currency.

Read more: Indo Zambia Bank secures highest credit rating, reinforcing robust financial resilience

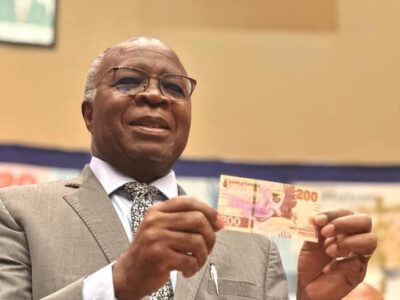

The bank’s board chairman, Dr. Michael Gondwe, revealed the positive results at a media briefing following the Annual General Meeting in Lusaka on Friday.

Gondwe attributed the success to strategic initiatives, including pursuing new deposits and improving relationships with existing customers.

“Total revenue for 2024 grew by 18.5 percent, reaching K2.00 billion, up from K1.69 billion in 2023. Our assets grew by 22.97 percent, closing at K20.85 billion as of December 31, 2023,” said Gondwe.

He further explained that total deposits rose by 20.83 percent, totaling K16.12 billion.

Gondwe also highlighted significant improvements in the bank’s loan portfolio.

“Loans and advances to customers increased from K5.87 billion in 2023 to K6.54 billion in 2024. Notably, the impairment loss on financial instruments decreased from K157.81 million to K31.34 million, signaling improved asset quality,” he said.

The bank’s total equity rose by 26.23 percent, reaching K2.89 billion, primarily driven by an increase in retained earnings.

He said as a result, shareholders approved a total dividend of K150 million for the year.

Managing Director, Brajesh Singh, praised the bank’s effective risk management strategies, which have helped navigate economic fluctuations.

“We remain steadfast in our commitment to maintaining a robust risk management and governance framework that emphasizes risk aggregation, addresses new and emerging risks, and enhances the bank’s resilience to risk,” Singh stated.

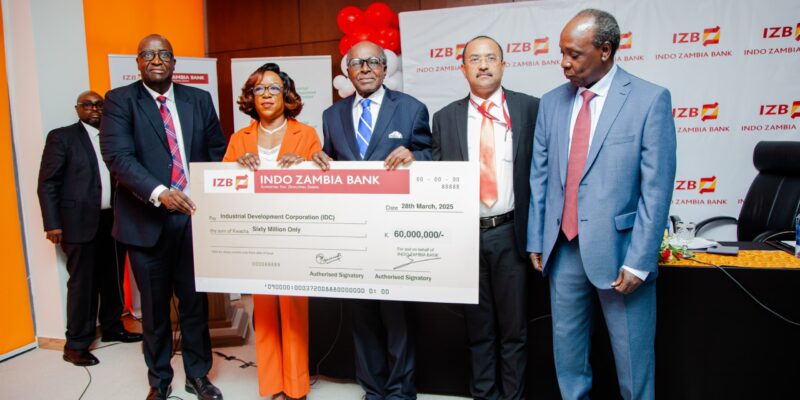

The Industrial Development Corporation (IDC) Chief Executive Officer, Cornwell Muleya, also expressed confidence in the bank’s future.

Speaking on his behalf, Leya Mtonga-Ngoma highlighted the value of strong partnerships, stating that IDC is excited by the K60 million dividend.

“We are very pleased to be receiving this dividend cheque of K60 million. Well, that’s the kind of cheque we love to receive! Indo Zambia Bank, you’ve set the bar high, and we expect more of these ‘happy surprises’ in the coming years,” he said.

Muleya said IZB had demonstrated resilience in a challenging market, showing its strength and leadership potential.

Following the briefing, the bank officially handed over the K60 million dividend to IDC, further solidifying its commitment to rewarding stakeholders and ensuring continued growth.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments