The Zambia Development Agency (ZDA) has released guidelines for accessing the US$29 million Zambia Export Development Fund (ZEDF), aimed at supporting local firms and Small and Medium Enterprises (SMEs) engaged in non-traditional exports.

The ZEDF, managed by the ZDA, recently secured US$25 million from development finance funders and other investors, bringing the total fund to US$29 million.

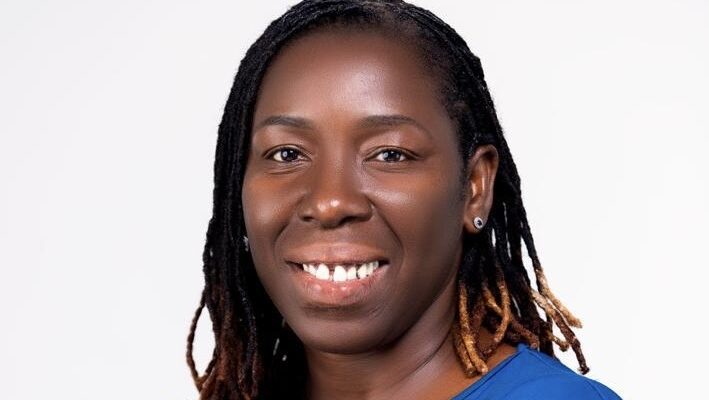

ZDA Head of Communications and Public Relations, Kwali Mfuni, confirmed this in a statement issued on Monday.

Mfuni outlined that to access the Export Development Fund (EDF), applicants must be incorporated or registered businesses with viable transactions involving established counterparties and verifiable off-takers.

She stated that firms should promote women and youth empowerment, demonstrate profitability, and contribute to job creation and foreign exchange earnings.

“ZEDF operates a revolving finance facility that provides working capital to non-traditional exporters to support and grow the export sector in Zambia. The Fund provides working capital on a 12-month tenure with a provision for two maximum rollovers subject to performance,” said Mfuni.

She added that the new funding line included project-specific finance with a repayment period of three to five years and semi-annual repayment options not exceeding two years.

Mfuni further guided that businesses should be export-ready in non-traditional sectors, wholly or majority Zambian-owned and have evidence of existing capacity and potential for export.

The business must also meet specific criteria, including a minimum annual turnover of K450,000 and the ability to fund a 25 percent co-contribution.

She said applicants must also demonstrate the capacity to achieve favorable export outcomes, with relevant experience, market expertise, collaboration with other organizations and a need for technical assistance if applicable.

An export strategy, delivery plan and a business plan demonstrating significant export potential are also required.

Mfuni noted that applicants are expected to complete the Standard ZEDF loan application forms, which required detailed business information, financial statements, and export plans.

Additional documents she said included business registration or incorporation certificates, feasibility studies or business plans, financial records (two years of audited or management accounts), and verifiable export orders and contracts.

“Once successful, the applicant will receive loan funds, which can be used for various export-related activities like product sales, product development, marketing, and expanding export capacity. All ZEDF loans are secured, and the Fund accepts different forms of collateral, including real estate, movable assets, and other types,” Mfuni stated.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments