Zambia’s Central bank has further squeezed liquidity in the economy by lifting the benchmark cost of money for the first time since November 2021.

This is meant to curtail a slide in the Kwacha that is placing upward pressure on inflation rate.

Recently, the Central Bank raised the statutory reserve ratio on commercial banks deposit liabilities by 2.5 percentage points to 11.5 percent as an additional measure to minimise exchange rate volatility.

Read more: Bank of Zambia threatens imprisonment for operators of ponzi, pyramid schemes

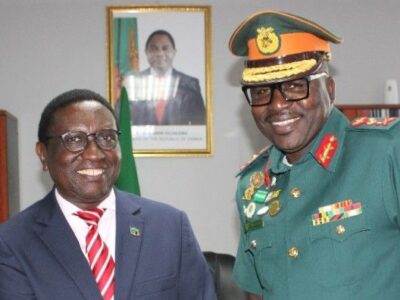

Today, the Bank of Zambia (BoZ) Governor, Denny Kalyalya, announced that the Monetary Policy Committee had decided to increase the policy rate to 9.25 percent from nine percent to further curtail a slide in the Kwacha.

Kalyalya explained that the decision was taken because of mounting inflationary pressures stemming from the Kwacha, which was weakening as a result of negative sentiments arising from the protracted debt-restructuring negotiations.

He regretted that the depreciation of the Kwacha had persisted in 2023, with the currency trading at K19.33 per United States dollar as at February 14.

‘”In addition, foreign financial institutions, that had typically been suppliers of foreign exchange are now more pronounced on the demand side as they are divesting from domestic market.

“This is principally due to tighter global financial conditions, negative sentiments associated with the debt restructuring negotiations and uncertainty around the treatment of non-resident holders of Government securities,” Kalyalya told reporters in Lusaka on Wednesday.

According to Kalyala, this moderate rate increase would allow other measures taken by the central bank to slow a slump in the currency such as increasing commercial lenders’ reserve ratios on February 13 to filter through, the governor said.

Also read: Policy Institute harps on downside of upward adjustment of reserve requirements

He warned that failing to halt the slide in the kwacha had the potential to undermine the emerging stable macroeconomic environment in Zambia

He also said plans to raise electricity tariffs by 37 percent and a possible reduction in maize output because of adverse weather conditions and infestations of fall armyworms may push up prices.

Delays in talks to restructure US$12.8 billion of external loans in Africa’s first pandemic-era sovereign defaulter have fuelled an almost 15 percent depreciation in Zambia’s currency against the dollar since the MPC’s last meeting on November 23, 2022.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR

Comments