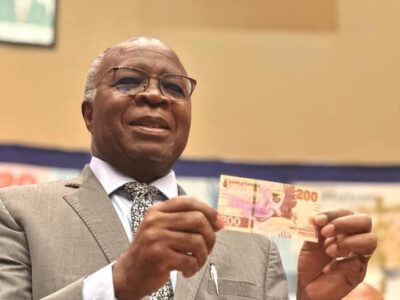

The Bank of Zambia has kept its benchmark lending rate steady at 13.5 percent, Governor Dr. Denny Kalyalya announced during a Monetary Policy Committee (MPC) briefing in Lusaka on Wednesday.

The central bank’s decision aims to steer inflation back within the target band of 6 to 8 percent, thereby promoting macroeconomic stability.

Kalyalya explained that the MPC considered the effects of the ongoing drought, the impact of previous rate hikes, adjustments to the statutory reserve ratio, and recent reforms in the foreign exchange market when making their decision.

“While actual and projected inflation remains elevated relative to the 6 to 8 percent target band, the Committee judged that the current monetary policy stance is appropriate,” Kalyalya said.

He added that the decision to maintain the rate, rather than increase it, also took into account the need to support financial system stability and economic growth, particularly in 2024, given the challenges posed by the drought.

Kalyalya highlighted the importance of continued fiscal consolidation measures, including the completion of external debt restructuring and structural reforms, as critical to lowering inflation, maintaining financial stability and fostering economic growth and resilience against shocks.

“In this regard, there is a need for concerted effort and strengthened collaboration among all stakeholders to effectively address current and emerging shocks to safeguard macroeconomic stability,” he emphasized.

Kalyalya also noted that growth prospects for 2023 remain pessimistic, with growth projected at 2.3 percent due to the adverse impact of the drought on the agriculture and energy sectors.

However, he expected growth to rebound in 2025, driven by recovery in the mining and agriculture sectors and sustained expansion in the ICT, financial and insurance, and wholesale and retail trade sectors.

Kalyalya said domestic credit growth increased to 11.7 percent at the end of June, up from 10.5 percent at the end of March, primarily due to increased lending to the private sector.

He noted that private sector credit expanded by 35.8 percent in nominal terms in June, compared to 30.5 percent in March.

Meanwhile, lending to the government through government securities contracted as liquidity conditions remained tight.

Kalyalya also indicated that mining tax receipts remitted directly to the Bank increased to US$252.5 million in the second quarter, up from US$190.8 million in the first quarter.

“Due to improved supply, the Bank scaled down market support to US$275.0 million from US$369 million in the first quarter,” he said.

On the international front, Kalyalya stated that gross international reserves increased to US$3.9 billion (equivalent to 4.3 months of import cover) at the end of June, up from US$3.6 billion (equivalent to 3.9 months of import cover) at the end of March.

He said this increase was primarily due to a US$569.6 million disbursement from the International Monetary Fund (IMF) under the ECF arrangement.

He added that in the second quarter of 2024, gold purchases amounted to US$8.6 million, bringing total holdings to US$176.7 million since the Bank began purchasing gold locally.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments