A high-level gathering on global financing reform and reparative justice has opened in Johannesburg, South Africa, highlighting Africa’s worsening sovereign debt crisis and its impact on economic gains.

The event, hosted by the African Forum and Network on Debt and Development (AFRODAD) in partnership with the African Monitor, Institute for Economic Justice (IEJ), and the Stop the Bleeding campaign (STBc), has heard that debt distress has forced African nations to implement harsh economic policies.

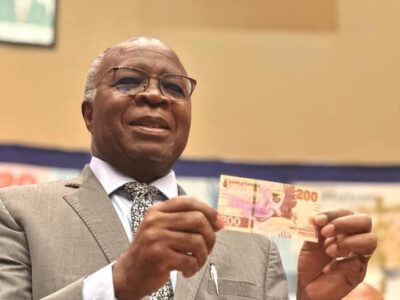

AFRODAD Board of Trustees member, Christian Ayiku, noted that Africa faces one of its worst debt crises, with countries like Zambia and Ghana resorting to unpopular austerity measures.

Zambia’s external debt rose from US$14.6 billion in December 2023 to US$15.43 billion by the end of 2024, pushing it to remove fuel subsidies under a US$1.3 billion IMF programme.

Read more: African countries urged to scale up domestic resource mobilisation, debt management

The group’s Executive Director, Jason Rosario Braganza, stressed that more than half of African nations were in debt distress, with many spending more on debt servicing than on public services like health and education.

He warned that a lack of transparent debt data undermined public accountability.

The conference also underscored the media’s critical role in shaping debt discourse, empowering citizens, and influencing policy decisions.

Participants urged African governments to advocate for fairer global financing terms to ease the debt burden.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments