The government has raised concerns over growing cybersecurity threats impacting various sectors, including insurance.

Insurers had gathered at the 2024 Annual Insurance Conference in Chongwe to discuss combating sector fraud, particularly from false claims.

Celebrated under the theme “Adapting to the Changing Landscape of Economic, Environmental, and Social Risks,” the conference united professionals from the insurance and related industries to enhance resilience in Zambia’s insurance sector.

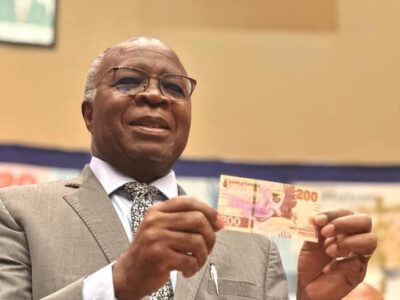

During Thursday’s opening ceremony, Finance and National Planning Minister, Situmbeko Musokotwane, stated the need for risk solutions that address evolving daily threats.

Musokotwane acknowledged the benefits and challenges of a growing digital landscape, underscoring cybersecurity as a serious and pressing reality.

His remarks were read by Acting Permanent Secretary for Economic Management and Finance, Mulele Mulele.

Read more: Civil Society Organisations unveil campaign to curb illicit financial flows in Zambia, Africa

Musokotwane also urged insurers to deliver a customer experience that would make complaints against insurance a thing of the past.

Earlier, Insurers Association of Zambia (IAZ) Executive Director, Nkaka Mwashika, noted that the conference served as a platform for insurers to explore growth opportunities and bolster resilience amid economic, climate, and social challenges.

Mwashika highlighted the focus on using artificial intelligence and information communication technology (ICT) to enhance customer experience and counteract fraudulent claims.

“Our discussions will center on improving the industry’s response to societal needs. We’ll also examine ways to combat fraud from exaggerated claims while enhancing service for genuine clients. Balancing know-your-customer requirements with simple service delivery remains a priority,” he said.

IAZ President, Irene Muyenga, added that the conference theme reflected the insurance sector’s commitment to addressing Environmental, Social, and Governance (ESG) issues.

Pensions and Insurance Authority (PIA) Registrar and Chief Executive Officer, Namakau Ntini, stressed the need for insurers to adapt to the changing landscape to ensure sustainability and effective risk management.

She emphasized that developing an ESG strategy was now essential for insurers to thrive amid industry challenges.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments