Kitwe District Chamber of Commerce and Industry has engaged Zambia Revenue Authority (ZRA) on its decision to impose conditions for issuance of tax clearance to enterprises.

Starting from January 1, 2024, the tax collector stopped issuing tax clearance certificates to entities with unresolved tax compliance issues.

Read more: ZRA alleges ‘too many fake, wrong documents’ as K17.2 billion VAT claims approved

But the Chamber vice president-commerce, Luckson Simwinga, said that the move would send most of the enterprises struggling with low business activities out of operation.

He explained this during an open day forum organised by Prospero Limited in Kitwe on Wednesday, saying that most businesses on the Copperbelt depended on the mining sector for business, adding that some mines were inactive.

“We are engaging ZRA on this issue, there is need for ZRA to revert to the old system where tax certificate was provided to enterprises as they normalise tax payments,” he said.

George Jere, a Kitwe based mine supplier observed that most suppliers were not getting business on account of lack tax clearance certificates.

“The decision by ZRA to only issue tax clearance certificates to up to date enterprises is worsening the already volatile business environment,” Jere said in an interview on Tuesday.

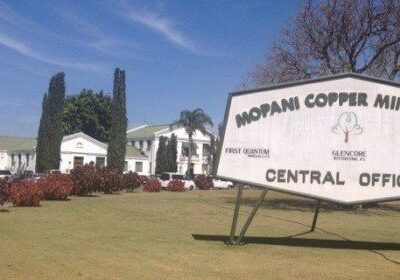

He said reduced activities at Mopani Copper Mine (MCM) and Konkola Copper Mine (KCM) have continued to have telling effects on businesses that were operating in the mining sector.

Jere observed that coming up with such a measure would restrict more entities from getting new orders and wondered how enterprises would redeem the tax debt if they were out of business.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments