The Bank of Zambia (BoZ) has launched the first publication of the Monetary Policy Report (MPR) presenting a detailed assessment of the path of inflation over the next eight-quarters.

The assessment is reportedly based on a careful and critical analysis of current domestic and global macroeconomic developments.

It is also said to provide an assessment of the Monetary Policy Committee (MPC) view on the balance of risks to the inflation projection.

The Central Bank says it expects that such an assessment would help provide greater clarity to stakeholders on the basis upon which the MPC arrived at its decisions.

The nation’s banker believes that the publication would enhance Central Bank’s transparency, accountability, communication and well-grounded interactions on monetary policy matters.

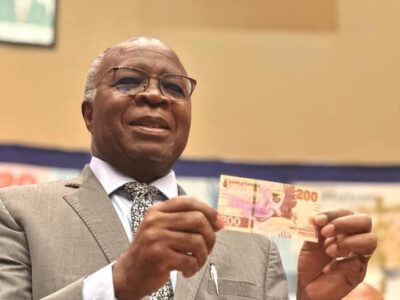

Governor, Denny Kalyalya, spoke at the launch of the Monetary Policy Report and Stakeholder Engagement in Lusaka on Monday.

“You might have noticed that in sharp contrast to the previous Monetary Policy Statements, the Statement published on February 14 was very compressed.

“This will become the norm and is in line with our objective of publishing the MPR, which provides salient detailed information on what informs the decision of the MPC on the Policy Rate,” Dr Kalyalya said.

Kalyalya added that it was also expected that the MPR would serve as a credible and reliable reference document for other economic policy makers, researchers, academics, and the public at large on economic developments in Zambia.

He explained that the report was also part of the attributes of the forward-looking monetary policy framework that BoZ adopted in April 2012 wherein communication of decisions was an important prerequisite.

“Back in April 2012, the Bank adopted the forward-looking monetary policy framework because the monetary aggregate targeting framework it had been using was no longer that effective in achieving the inflation objective, due to the changes that had happened and were happening to the structure of the economy.

“In addition, it was observed that the changes in monetary policy aggregates were no longer reliable indicators of current and future developments in inflation. It had also become difficult to signal the stance of monetary policy, which we believe is critical to anchor inflation expectations,” Kalyalya said.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments