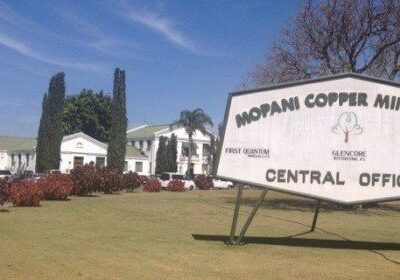

Aeronautic scientist, Clive Chirwa, has urged ZCCM-IH shareholders to oppose Mopani Copper Mine (MCM) earmarked 51 equity share sale to an investor for US$1.1 billion.

“This is a rip-off especially when Mopani spent US$1.5 billion to buy itself from Glencore in 2021, which is already a loss,” Chirwa said.

He said in a statement on Tuesday that Mopani had rich copper resources which could afford to generate around US$1.84 billion from its 80,000 tonnes of annual production.

Chirwa argued that once the production reached the apex of around 200,000 tonnes per annum, the company could make a whopping US$4.6 billion which was capable of paying back Glencore debt of US$1.5 billion.

Read more: ZCCM-IH and IRH-Mopani deal: Not good enough, by James Musonda

“I will not support the sale for the reason that Mopani is an extremely rich concern and should take a step back and invite Zambians who can help it achieve its goal of 254,000 tonnes per year with added value ,” he stated.

“I am talking from a position of authority in this engineering subject that involves post mining wealth creation for a nation. I was astonished to see Mopani in that faded light. It was a sad story that has to be regenerated in national interest,” he said.

Chirwa claimed that he had a plan of how to revive the mining company under 100 percent ownership by ZCCM-IH Plc adding that the sum of money associated with Mopani problems was minute and obtainable within the current monetary framework of the company.

“Indeed, solvable with minimal expenditure by Mopani and with some inputs by the government. The company has all the money in-house and can capitalise its assets freely,” he said, adding that finance and labour were not part of the problems.

Recently, ZCCM-IH and the government announced that International Resources Holding (IRH) of the United Arab Emirates had been offered 51 shares in exchange of US$1.1 billion to be invested in Mopani, to pay restructured Glencore debt among others.

On February 23, 2024, ZCCM-IH is scheduled to hold an extraordinary general meeting to seek shareholders consent ahead of the Mopani deal.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments