The Bank of Zambia (BoZ) has reported an oversubscription in its last Friday bond auction with significant interest in three, 10 and 15-year assets.

This led to interest yielding 22.0 percent, 25.2 percent and 26.7 percent respectively.

The Kwacha Arbitrageur magazine reported on Monday that of the K3.99 billion (at cost) bids, the BoZ absorbed K3.85 billion (at cost) of the K2.6 billion fixed income assets on offer.

“Yields were unchanged across the spectrum save the seven year that ebbed 100 basis points to 23.0 percent,” according to the magazine.

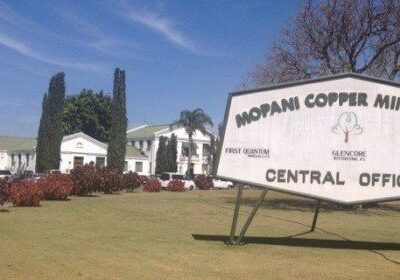

Read more: Bank of Zambia dumps $68 million into foreign exchange market to shore up falling Kwacha

It indicated that Zambia continued to register offshore interest from players that still held a bullish view around the sovereign posture post full debt restructure.

“The copper currency on the other hand has continued on a persistent losing streak flirting with new psychological high weekly which is feared could erode the economic gains accrued from the strides earned year to date,” the magazine stated.

Earlier last month the BoZ raised the cash reserve ratio 550 bps to 17.0 percent in a space of two weeks in addition to upward adjusting of its benchmark interest rate to 11.0 percent in the quest to stem a currency slide that continues to depreciate.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments